At a Glance

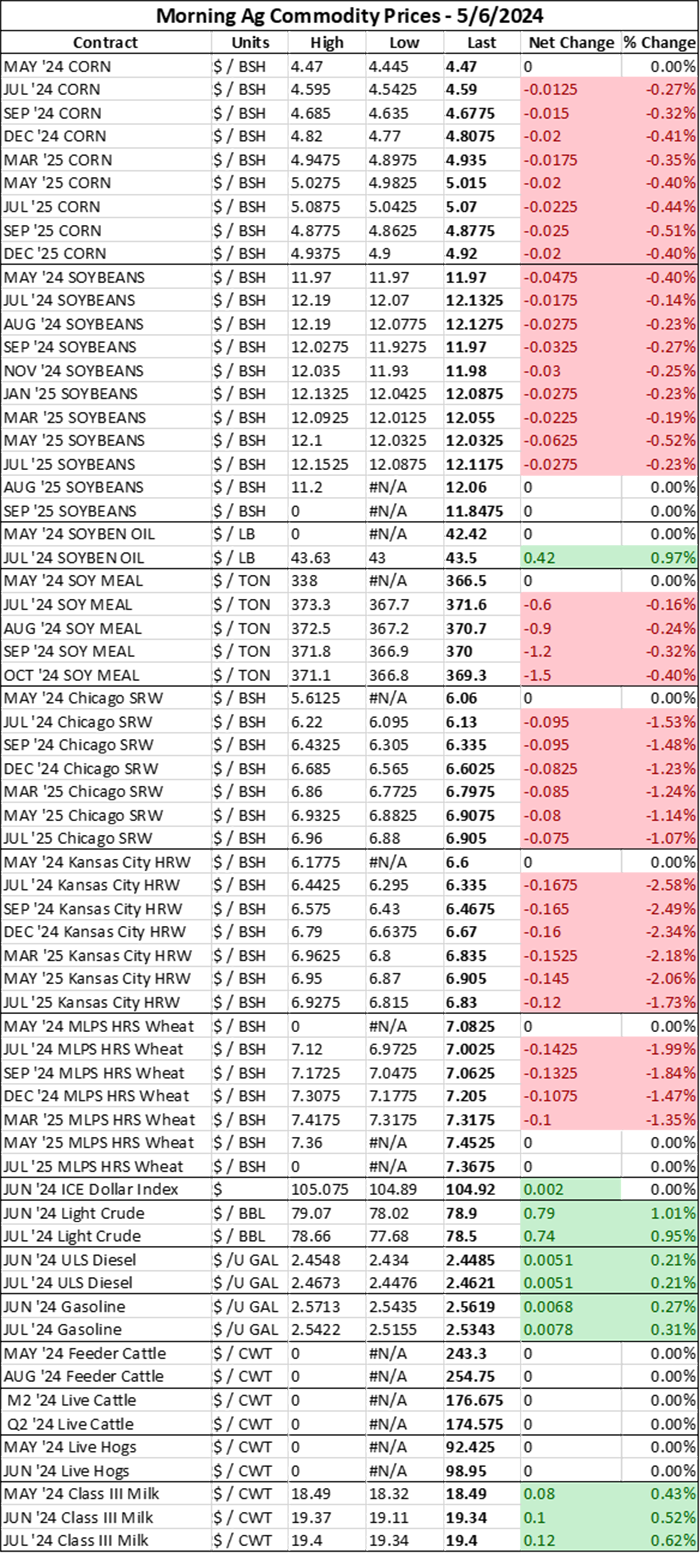

- Corn down 1-3 cents

- Soybeans down 3-6 cents; Soyoil up $0.37/lb; Soymeal down $1.60/ton

- Chicago SRW wheat down 7-8 cents; Kansas City HRW wheat down 14-15 cents; Minneapolis spring wheat down 12-13 cents

Prices updated as of 6:55am CDT.

Feedback from the Field

Were you able to dodge showers over the weekend and keep your planter rolling?! Share your insights with us in our ongoing Feedback from the Field survey!

Feedback from the Field is an open-sourced, ongoing farmer survey of current crop and weather conditions across the Heartland. If you would like to participate at any time throughout the growing season, click this link to take the survey and share updates about your farm’s spring progress. I review and upload results daily to the FFTF Google MyMap, so farmers can see others’ responses from across the country – or even across the county!

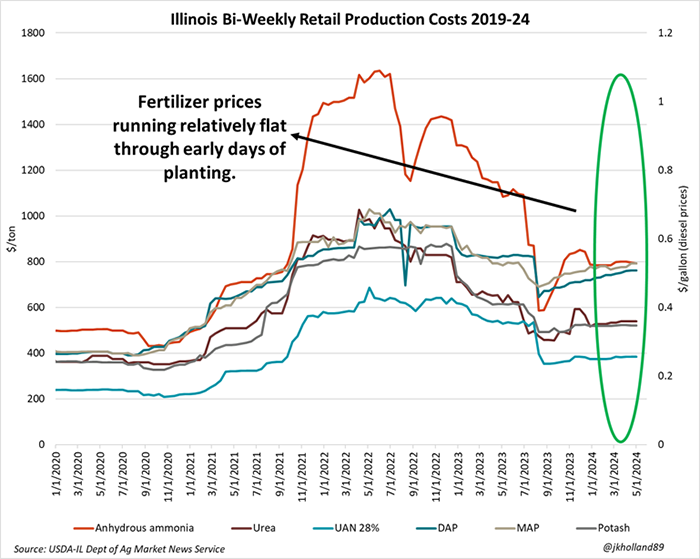

Retail fertilizer prices

USDA’s Agricultural Marketing Service (AMS) has taken over the bi-weekly Illinois Production Cost Report from the Illinois USDA’s Department of Ag Market News Service over the past month. In that time, AMS has added a few new cost metrics critical to on-farm production, including ATS (sulfate), UAN 32% (liquid nitrogen 32% spread), and biodiesel.

This is great news for farmers – more retail price information about key inputs used for row crop production will only help farmers make more informed decisions about profit (or in this case, cost) opportunities.

In Friday’s most recent price update, retail fertilizer prices in Illinois were largely unchanged from the previous report two weeks prior. Anhydrous ammonia prices eased over $4/ton over that two-week period to an average of $791.67/ton. Number 2 farm diesel and biodiesel were quoted $0.10/gallon lower at $3.36/gal and $3.18/gal, respectively.

All other major prices were unchanged. Quote ranges appeared to not have been updated, either. I suspect that the transition from the Illinois USDA to AMS has incurred a few glitches, which is why other nitrogen products, phosphate, potash, and sulfate prices were not updated in Friday’s report.

If I’m wrong – and I hope I am – and these input prices have been quoted largely unchanged over the past two weeks, then these nitrogen input prices continue to be quoted at 13% to 27% lower than a year ago. Phosphate prices continue to be sticky, with DAP prices quoted 8% lower while MAP prices are 1% higher than a year ago. Potash prices are 15% lower and diesel is up 2% from last year.

Input prices have been quoted relatively flat since the beginning of 2024. But between the beginning of last fall’s harvest season and the beginning of May, NPK prices have slowly crept up – particularly for nitrogen.

For farmers looking to book last-minute fertilizer purchases during planting this spring, rest assured that you will be paying significantly less than a year ago. But this “price stickiness” we are watching unfold in the Illinois Production Costs report suggests that NPK prices might be trading at a floor.

And with many of the pandemic-era supply kinks ironed out in the fertilizer industry, fertilizer producers may be reluctant to overproduce this summer during the restock period. That means we may not see major price drops in fertilizer prices this fall.

The funds

Last week’s rallies in the wheat market were fueled by drought fears in top global exporter Russia. But some of the market action was also compounded by a round of short-covering by speculative traders, who backed off large net short positions on the revived supply jitters in the wheat market.

“In the week ended April 30, money managers cut their net short position in CBOT wheat futures and options to 47,866 contracts from 76,184 a week earlier, marking their least bearish wheat view since July,” market analyst Karen Braun wrote for Reuters over the weekend.

“History strongly hinted at funds’ latest moves. Whenever funds have been heavily bearish wheat this time of year, they spend at least two weeks being forced out of short positions at some point between April and June, but the net short does not have to disappear entirely, as was the case last year.”

The speculators’ short position on corn was also narrowed in Friday’s Commitment of Traders report from the CFTC, reflecting wheat’s spillover strength. Speculators were split on soymeal and soyoil last week, strengthening long positions on soymeal in the wake of Argentine worker strikes and selling off more soyoil contracts amid large U.S. supplies.

Worries about flooding in Southern Brazil, higher energy prices on Middle East conflict concerns, and low Malaysian palm oil exports in April will continue to influence the U.S. soybean complex through the first half of this week. Prices may be trading lower this morning, but we are finally starting to see some supply news for soybeans that could keep a floor under prices this week.

Corn

Corn prices shed $0.01-$0.03/bushel this morning, dropping most actively traded Jul24 futures to $4.5825/bushel and new crop Dec24 contracts to $4.80/bushel at last glance. Nearby May24 prices edged up $0.02/bushel to $4.49/bushel, likely reflecting end users trying to coax more farmer supplies out of the countryside, even though most farmers are busy with spring fieldwork activities right now.

Grain and oilseed markets are taking a bit of a breather this morning after a chaotic trading session last week. Markets are also in “wait-and-see” mode as we all wait for USDA’s first look at 2024/25 production, supply, and usage estimates in Friday’s WASDE report, which will also provide updates on current marketing year usage and South American production forecasts.

Markets are also awaiting planting progress updates for corn and soybeans in today’s Crop Progress report from USDA. Farmers across the Heartland dodged showers for a good chunk of last week, but today’s report will show if any meaningful progress was made in between rain drops.

Spoiler alert – based on Feedback from the Field responses, I’m guessing we are going to continue to be on track for timely corn and soybean plantings in today’s report.

Corn and soybean markets are trying to evaluate potential USDA downward revisions to ongoing South American corn and soybean harvests. In Argentina, corn yields are believed to have been damaged by leafhoppers. Southern Brazil is facing massive flooding damage to first crop corn (though most has been harvested) while safrinha crops in Brazil’s Center West (Mato Grosso) are facing increasing drought risks.

Soybeans

Soybean prices fell $0.03-$0.06/bushel this morning, dropping nearby May24 futures back below the $12/bushel benchmark at $11.97/bushel. Most actively traded Jul24 prices dipped to $12.125/bushel while new crop Nov24 futures fell to $11.9725/bushel.

Soy markets are taking a pause this morning ahead of this week’s data updates. A bit of profit-taking is also at play after last week’s furious rallies on massive soymeal exports in March, flooding worries in Brazil, and strike activity in Argentina.

Even though Argentina’s oilseed and dock workers’ strike ended quickly last week, the world’s largest soymeal exporter is likely to face more strike pressure from its trucker and public transportation unions early this week.

Argentine truck drivers, bus, airplane, subway, and train workers will begin strike activity today to protest President Javier Milei’s re-introduction of an income tax on sections of Argentina’s population that are largely comprised of middle-class workers in the aforementioned transportation industries.

“On May 6 in the morning hours and around noon, the activities in air, land, port, and maritime transport will be interrupted in rejection of the fiscal agreement that again sanctions the Earnings Tax,” Argentine Confederation of Transport Workers (CATT) Secretary-General Juan Carlos Schmid posted on X (the website formerly known as Twitter).

Essentially, the strike will bring anything with wheels to a halt on Monday. Not only will public transportation be closed, but grain and oilseed exports and energy supply movement will be paused.

Argentina is the world’s largest soymeal and soyoil exporter and the world’s third largest corn and soybean exporter. While the markets are largely brushing off concerns about this strike in the early morning hours, it will be a key driver of price activity through the first half of this week.

Wheat

Even with a weaker dollar this morning, U.S. wheat prices still fell $0.05-$0.14/bushel as rains in the U.S. Plains some profit-taking took a bite out of last week’s wheat rally on Russian crop downgrades and U.S. drought worries.

U.S. wheat markets will continue to be responsive to Russian weather forecasts this week. Early morning reports suggest that Southern Russia’s top wheat-producing region may have been hit by light frosts over the weekend. Traders don’t think the frost lasted long enough to cause measurable damage, but the crop continues to face imminent drought damage.

Weather

Temperatures will continue to run above average into the middle of next week, according to NOAA's 6-10-day outlook, but only for the area east of the Southern Plains to the Upper Midwest. At that time, temperatures will trend below average for the Western Plains and Pacific Northwest, though they will continue to run warm further east. Above average chances for showers will continue to stretch across the upper two-thirds of the country, with the Northern Border and the Great Lakes region experiencing the highest chances of accumulation.

Warm temperatures will continue recede through late next week in NOAA’s 8-14-day forecast. During that time, the High Plains and Upper Plains will battle below average temperatures, while the Upper Midwest sees more seasonal norms with regard to temps. The Southern Plains through the Eastern Corn Belt will still be enjoying warmer than average temperatures next weekend. Moisture forecasts are once again projecting an above average chance for widespread showers across the Heartland during that time, with the Southern Plains and Southeast enjoying the highest chances for moisture.

It's not idyllic planting weather forecasted into next week, so farmers can expect to continue dodging showers as they race to complete planting activities.

Farm bill

On Wednesday, Congressional ag leaders announced they would soon be considering farm bill proposals, raising hopes that last year’s extension of the 2018 Farm Bill would be short-lived. Policy editor Joshua Baethge chronicles Wednesday’s announcement and analyzes the various responses.

“While a new bill this year is far from certain, most agree that any sign of progress is a good thing,” Baethge writes. Baethge also emphasizes that cautious optimism is the best approach to take when reading these announcements, noting that differing proposals highlight divergent priorities across the ag world.

The proposals promote sustainable agricultural production, maintain conservation practices, create more opportunities for young and beginning farmers, and strengthen the farm safety net, without sacrificing nutrition security measures – a rare winning proposal for everyone.

“Still, after months of little movement, the push for a new farm bill seems to be gaining momentum,” Baethge adds. “Maybe.”

What else I’m reading at www.FarmFutures.com this morning:

Naomi Blohm examines if we’ve hit the “spring low” for corn prices.

My latest E-corn-omics column takes a quick look at major market factors for corn, soybean, wheat, and fertilizer markets.

Policy editor Josh Baethge summarizes the Biden administration’s new sustainable aviation fuel standards and shares some of the challenges farmers may face with the program.

Analyst emeritus Bryce Knorr is watching these four marketing items as peak planting season ramps up.

Just like in the NFL draft last week, AgMarket.Net hedging strategist Tyler Schau recommends farmers stick to their strategy when it comes to grain marketing plans.

About the Author(s)

You May Also Like